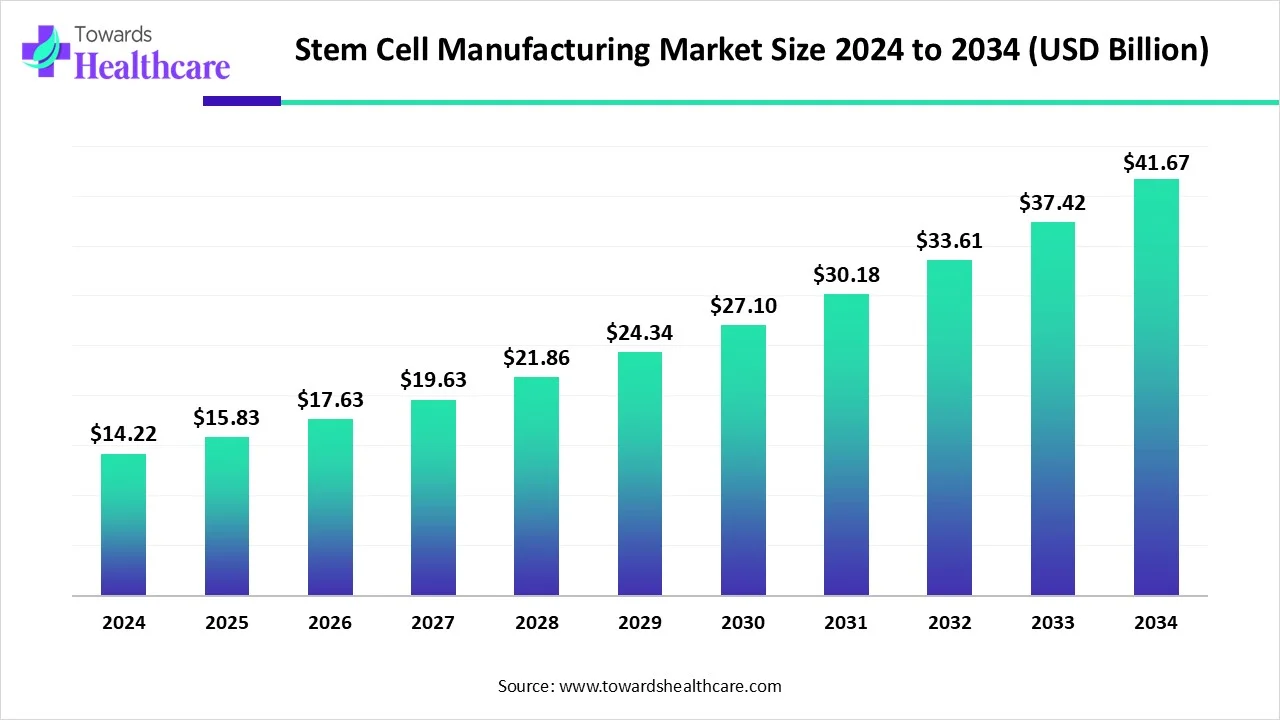

Stem Cell Manufacturing Market to Reach USD 41.67 Billion by 2034, Growing at an 11.35% CAGR

The global stem cell manufacturing market size was valued at USD 15.83 billion in 2025 and is predicted to hit around USD 41.67 billion by 2034, rising at a 11.35% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Jan. 29, 2026 (GLOBE NEWSWIRE) -- The global stem cell manufacturing market size is calculated at USD 17.63 billion in 2026 and is expected to reach around USD 41.67 billion by 2034, growing at a CAGR of 11.35% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5603

Key Takeaways

- North America accounted for the largest share of the market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By product, the consumables segment registered dominance in the market in 2025.

- By product, the instruments segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the clinical applications segment led the stem cell manufacturing market in 2025.

- By application, the research applications segment is expected to grow notably in the upcoming years.

- By end-user, the pharmaceutical & biotechnology companies segment dominated the market.

- By end-user, the academic institutes, research laboratories, & contract research organizations segment is expected to grow at a lucrative CAGR during 2026-2035.

What is Stem Cell Manufacturing?

Stem cell manufacturing is the controlled process of isolating, expanding, differentiating, and preserving stem cells under regulated conditions to produce safe, consistent, and clinically usable cell products for research, therapy, or commercial application. The stem cell manufacturing market is growing due to rising demand for regenerative therapies, increasing prevalence of chronic and degenerative diseases, and expanding clinical research in cell-based treatments. Additionally, growing investments from biotech companies and supportive regulatory frameworks for advanced therapies are accelerating market expansion.

What are the Prominent Drivers in the Market?

The stem cell manufacturing market is driven by growing demand for regenerative medicine, increasing use of stem cells in clinical trials, and rising incidence of chronic and degenerative diseases. Advancements in automated cell processing, scalable manufacturing platforms, and strict quality control systems enhance production efficiency. Strong investment from biotechnology firms and supportive regulatory pathways further accelerate market development.

What are the Substantial Trends in the Stem Cell Manufacturing Market?

- In March 2025, Canada announced USD 49.9 million in Strategic Innovation Fund support for STEMCELL Technologies to scale manufacturing for diagnostics, vaccines, and therapies, creating jobs and student co-op opportunities.

- In April 2024, SCG Cell Therapy and A*STAR jointly funded labs (~S$30M) in Singapore to develop GMP-compliant iPSC-based cell therapies and train future regulatory-ready experts.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the Emerging Challenge in the Market?

The stem cell manufacturing market faces several emerging challenges, including high production costs, stringent regulatory requirements, and difficulties in scaling up processes. Ensuring consistent product quality, managing complex cell culture techniques, and addressing the shortage of skilled personnel further hinder market expansion.

For Instance,

-

In February 2025, the ISCT reported that producing a single dose of CAR-T cell therapy can cost between USD 100,000 and USD 400,000, varying by cell type and manufacturing method.

Regional Analysis

What Made North America Dominant in the Stem Cell Manufacturing Market in 2025?

North America dominated the market in 2025 due to its strong biotechnology ecosystem, high R&D spending, and large number of oncology clinical trials. The region benefits from advanced manufacturing infrastructure, early adoption of automation, and the presence of leading stem cell companies. Supportive regulatory pathways, strong funding from public and private sectors, and close collaboration between academia and industry further reinforced North America’s Market leadership.

For Instance,

-

In August 2025, the ISSCR updated its guidelines to reinforce ethical, scientific, and regulatory standards, aiming to ensure safe clinical use of stem cell therapies and prevent premature commercialization.

In the U.S., stem cell manufacturing is expanding with increased research infrastructure, investment in bioprocessing technologies, and supportive regulatory frameworks. U.S. facilities scale up production to meet rising clinical and therapeutic demand, with numerous trials and advanced platforms driving deeper industry capabilities.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2025?

Asia Pacific expanded at the fastest pace in the stem cell manufacturing market in 2025, due to rising government funding, rapid growth in clinical research, and increasing demand for regenerative therapies. Countries such as China, Japan, South Korea, and Singapore strengthened manufacturing capabilities through supportive policies and public-private partnerships. Lower production costs, expanding biotech infrastructure, and a growing pool of skilled researchers further accelerated regional market growth.

For Instance,

-

In September 2024, Chinese authorities launched a pilot initiative permitting foreign-funded companies to develop and manufacture human stem cell, gene diagnostic, and therapy products in select regions, including Beijing, Shanghai, and Guangdong.

In China, the stem cell manufacturing market growth is fueled by national biotechnology initiatives, rising private funding, and a rapidly evolving regenerative medicine ecosystem. Growing domestic production capacity and innovation in culture media and iPSC technologies enhance China’s role in Asia’s broader stem cell industry expansion.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Product Analysis

Which Product Led the Stem Cell Manufacturing Market in 2024?

In 2025, the consumables segment dominated the market due to their repeated and essential use throughout cell isolation, expansion, differentiation, and preservation processes. Items such as culture media, regents, growth factors, and disposables are required for every manufacturing batch, ensuring consistent demand. Continuous research activity, rising clinical trials, and strict quality and stability requirements further increased reliance on high-quality consumables.

The instruments segment is expected to grow at the fastest CAGR during the forecast period due to the rising adoption of automated and closed-system manufacturing technologies. Growing demand for scalable, consistent, and GMP-compliant stem cell production is driving investment in bioreactors, cell processors, and monitoring systems. Technological advancements that reduce manual handling, improve efficiency, and lower contamination risks further support the rapid growth of this segment.

By Application Analysis

Why did the Clinical Applications Segment Dominate the Market in 2025?

The clinical applications segment led the stem cell manufacturing market in 2025 due to the growing use of stem cells in approved therapies and late-stage clinical trials. Rising demand for regenerative treatments in oncology, neurology, and orthopaedics increased the need for large-scale, GMP-compliant cell production. Additionally, higher investment from trials to clinical use strengthened this segment's market leadership.

The research applications segment is expected to grow notably in the coming years due to expanding stem cell research in disease modelling, drug discovery, and toxicology testing. Increasing academic and biotech investments, rising use of iPSCs, and growing demand for high-quality research-grade cells are driving growth. Supportive government funding and collaborations between universities and industry further accelerate adoption in preclinical and translational research activities.

By End-User Analysis

How did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2025?

The pharmaceutical & biotechnology companies segment dominated the stem cell manufacturing market in 2025 due to their strong financial resources, advanced R&D capabilities, and active involvement in cell-based therapy development. These companies led large-scale manufacturing for clinical trials and commercial therapies, supported by automated production platforms and GMP compliance. Strategic collaborations, acquisitions, and increased investment in regenerative medicine further strengthened their dominant position.

The academic institutes, research laboratories, & contract research organizations segment is expected to grow at a lucrative CAGR during 2026–2035 due to expanding basic and translational stem cell research. Rising government and private funding, increased use of stem cells in disease modeling and drug screening, and growing outsourcing of early-stage research to CROs are driving demand. Strong collaborations with biotech and pharmaceutical firms further support sustained growth.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

What are the Recent Developments in the Stem Cell Manufacturing Market?

- In December 2025, the U.S. FDA approved Omidubicel-onlv, the first hematopoietic stem cell transplant therapy for treating severe aplastic anemia in patients aged six and above following reduced-intensity conditioning.

- In January 2024, Cipla formed a U.S. joint venture with Manipal Group and Kemwell Biopharma to develop and commercialize innovative cell therapies for the U.S., Japan, and Europe, with Cipla holding a 35.2% stake.

Stem Cell Manufacturing Market Key Players List

- Thermo Fisher Scientific, Inc.

- Lonza Group

- Eppendorf AG

- Miltenyi Biotec GmBH

- Anterogen Co. Ltd.

- American Cryostem Corporation

- Pluristem Therapeutics Inc.

- Daiichi Sankyo

- Sartorius AG

- Danaher Corporation

- CellGenix GmbH

- PromoCell

-

Organogenesis Holdings Inc.

Browse More Insights of Towards Healthcare:

The global stem cell banking market size is calculated at USD 9.12 billion in 2025, grow to USD 10.59 billion in 2026, and is projected to reach around USD 40.72 billion by 2035, rising at 16.14% CAGR from 2026 to 2035.

The global stem cell reconstructive market size is calculated at US$ 1.88 billion in 2025, grew to US$ 2.28 billion in 2026, and is projected to reach around US$ 12.48 billion by 2035. The market is expanding at a CAGR of 20.81% between 2026 and 2035.

The global stem cell assay market size is calculated at US$ 2.68 billion in 2024, grew to US$ 3.15 billion in 2025, and is projected to reach around US$ 13.5 billion by 2034. The market is expanding at a CAGR of 17.55% between 2025 and 2034.

The global stem cell therapy market size is calculated at USD 613.7 million in 2025, grew to USD 768.72 million in 2026, and is projected to reach around USD 5835.53 million by 2035. The market is expanding at a CAGR of 25.26% between 2026 and 2035.

The global autologous stem cell & non-stem cell therapies market size is calculated at US$ 5.15 billion in 2024, grew to US$ 6.81 billion in 2025, and is projected to reach around US$ 82.32 billion by 2034. The market is expanding at a CAGR of 32.26% between 2025 and 2034.

The global PRP and stem cell alopecia treatment market size was estimated at USD 489.27 million in 2025 and is predicted to increase from USD 515.93 million in 2026 to approximately USD 831.79 million by 2035, expanding at a CAGR of 5.45% from 2026 to 2035.

The global placental stem cell therapy for neurological disorders market size is calculated at US$ 535.65 million in 2025, grew to US$ 632.81 million in 2026, and is projected to reach around US$ 2836.93 million by 2035. The market is expanding at a CAGR of 18.14% between 2026 and 2035.

The global induced pluripotent stem cells market size is calculated at USD 1.93 billion in 2024, grew to USD 2.13 billion in 2025, and is projected to reach around USD 5.12 billion by 2034. The market is expanding at a CAGR of 10.25% between 2024 and 2034.

The global cancer stem cells market size is calculated at US$ 3.2 in 2024, grew to US$ 3.51 billion in 2025, and is projected to reach around US$ 8.04 billion by 2034. The market is expanding at a CAGR of 9.64% between 2025 and 2034.

The U.S. CAR T-cell therapies market size was valued at US$ 2.71 billion in 2025 and is projected to grow to 3.43 billion in 2026. Forecasts suggest it will reach approximately US$ 42.61 billion by 2035, registering a CAGR of 30.40% during the period.

Segments Covered in the Report

By Product

- Consumables

- Culture Media

- Other Consumables

- Instruments

- Bioreactors and Incubators

- Cell Sorters

- Other Instruments

- Stem Cell Lines

- Hematopoietic Stem Cells (HSC)

- Mesenchymal Stem Cells (MSC)

- Induced Pluripotent Stem Cells (iPSC)

- Embryonic Stem Cells (ESC)

- Neural Stem Cells (NSC)

- Multipotent Adult Progenitor Stem Cells

By Application

- Clinical Applications

- Allogenic Stem Cell Therapy

- Autologous Stem Cell Therapy

- Research Applications

- Life Science Research

- Drug Discovery and Development

- Cell & Tissue Banking Applications

By End-user

- Pharmaceutical & Biotechnology Companies

- Academic Institutes, Research Laboratories & Contract Research Organizations

- Hospitals & Surgical Centers

- Cell & Tissue Banks

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5603

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.